Comments on ERISA’s 50th anniversary–reforms to increase affordability and quality in employer-sponsored health coverage

U.S. House of Representatives

2176 Rayburn House Office Building

Washington, DC 20505-6100

Dear Chairwoman Foxx, Ranking Member Scott, and Members of the Committee:

The HIV+Hepatitis Policy Institute, a leading national HIV and hepatitis policy organization promoting quality and affordable healthcare for people living with or at risk of HIV, hepatitis, and other serious and chronic health conditions, thanks you for the opportunity to offer comments in response to your Request for Information: ERISA’s 50th Anniversary: Reforms to Increase Affordability and Quality in Employer-Sponsored Health Coverage, specifically in relation to the section on Specialty Drug Coverage, which is so critical to treating, curing, and preventing so many health conditions.

Employer-sponsored insurance is the most common form of health insurance in the United States, covering over 60 percent of the population under 65.[1] As we detail below, many employers have begun to create new health insurance barriers that prevent employees and their family members from accessing the medications they need to stay alive and healthy. Our comments focus on certain novel benefit designs that have become more prevalent in recent years among employer-sponsored insurance plans: copay accumulators, copay maximizers, and alternative funding programs, as well as the practice of skirting ACA requirements by designating certain specialty medications as non-Essential Health Benefits.

We call on the Congress to conduct greater oversight of employers on how they are limiting prescription drug access for their employees and families, including these little-understood but increasingly common benefit designs that, under the radar, have dramatically limited access to life-saving prescription drugs in employer-sponsored insurance plans.[2] We also ask Congress to urge the Department of Labor to take the appropriate steps so that these benefit designs are not permitted in ERISA plans, and increase its enforcement of ERISA plans to ensure they are in compliance with all patient protections included in the ACA, including adequate coverage of prescription drugs and zero-cost sharing for preventive services.

Copay Assistance & Copay Accumulators

There is no doubt that patients need copay assistance in order to afford their prescription drugs, due to high cost-sharing, often expressed in term of co-insurance based on the list price of a drug, along with high deductibles.

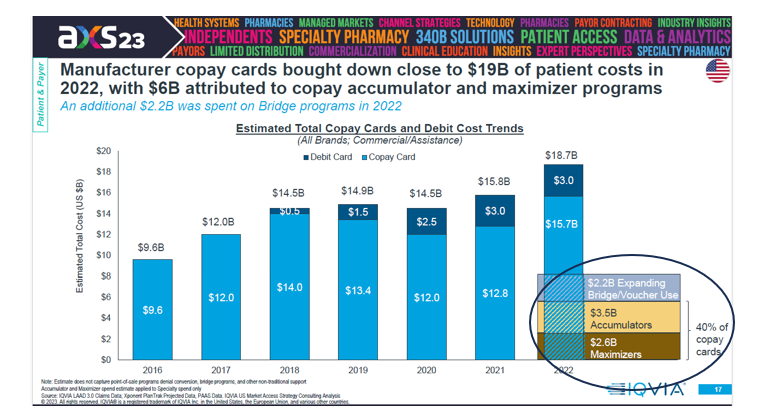

In 2022, according to IQVIA, patient out-of-pocket costs in 2022 were $82 billion for prescription drugs. That was an increase of $3 billion from 2021.[3] Manufacturer copay assistance brought down patient costs by nearly $19 billion and accounted for 23 percent of the out-of-pocket costs. Over the last five years, it accounted for $80 billion.[4]

Without these contributions, the American people would have had to come up with all this money, which most people do not have.

Consider the following:

The Commonwealth Fund 2023 Health Care Affordability Survey found that:

- Large shares of insured working-age adults surveyed said it was somewhat or very difficult to afford their health care: 43 percent of those with employer coverage and 57 percent with Marketplace or individual-market plans.

- Many insured adults said they or a family member had delayed or skipped needed health care or prescription drugs because they couldn’t afford it in the past 12 months: 29 percent of those with employer coverage and 37 percent covered by Marketplace or individual-market plans.

- Cost-driven delays in getting care or in missed care made people sicker. Fifty-four percent of people with employer coverage who reported delaying or forgoing care because of costs said a health problem of theirs or a family member got worse because of it, as did 61 percent in Marketplace or individual-market plans.

- Insurance coverage didn’t prevent people from incurring medical debt. Thirty percent of adults with employer coverage were paying off debt from medical or dental care, as were 33 percent of those in Marketplace or individual-market plans.

- Medical debt is leading many people to delay or avoid getting care or filling prescriptions: more than one-third (34 percent) of people with medical debt in employer plans while 39 percent in Marketplace or individual-market plans.[5]

- According to CMS, the 2024 silver plan median deductible increased from $5,440 in 2023 to $5,726 in 2024, an increase of 5 percent from 2023 and 19 percent from 2020. The bronze plan median deductible in 2024 is $7,239, which is a decrease of 3 percent from 2023, but an increase of 6 percent from 2020.[6]

- According to CMS’ 2022 National Health Expenditures report, while overall healthcare spending grew at 4.1 percent in 2022, out-of-pocket spending increased substantially higher at 6.6 percent in 2022 to $471.4 billion. For prescription drugs, out-of-pocket spending totaled $56.7 billion, or 14 percent of the total spending on prescription drugs. This represents an increase of 11.6 percent in 2022 after slower growth of 6.4 percent in 2021.

However, for hospital care, which accounts for more than three times more of the total spending than prescription drugs, patients were responsible for paying only 2.6 percent. Despite the much smaller total amount of spending for prescription drugs, the out-of-pocket spending for prescription drugs ($56.7 billion) was higher than all the out-of-pocket spending for hospitals ($35.1 billion).[7]

- According to an IQVIA analysis, due in part to high costs, an estimated 92 million prescriptions were abandoned at the pharmacy in 2022 (this compares to 81 million in 2021), with the abandonment rate over one in three for prescriptions above $75 in out-of-pocket costs. Additionally, for prescriptions with a final cost above $250, 53 percent are not picked up by patients, as compared with 7 percent of patients who do not fill when the cost is less than $10.[8]

While after premiums are paid there are cost-sharing limits, they too are rising. For plan year 2025, CMS has set the maximum out-of-pocket responsibility at $9,450 for an individual and $18,900 for all others. Due to the proliferation of high deductible plans, depending on the drug, a patient may be required to pay the total amount of $9,500 all at once for their medication at the beginning of the year.

While there has been much attention to the list price of medications, out-of-pocket costs are set by the insurers. Due to insurance benefit design, they are forcing beneficiaries to pay a high amount of costs, especially compared to other healthcare services. Since patients cannot afford these costs, copay assistance is essential.

In recent years, insurers have implemented harmful copay accumulator programs. While the insurers and PBMs collect the copay assistance meant for patients, they do not count that assistance towards the beneficiary’s cost-sharing obligations. As a result, the insurer double bills and collects more money than they should and the beneficiary ends up having to pay thousands of dollars that they did not anticipate and probably do not have.

In September 2025, the District Court for D.C. in HIV and Hepatitis Policy Institute et al. v. HHS et al. struck down the section of the 2021 Notice of Benefits and Payment Parameters rule that allowed issuers to decide if copay assistance can count or not, and that same Court clarified, at the government’s request, that the 2020 Notice of Benefits and Payment Parameters rule is now in effect and issuers must count copay assistance in most instances and not implement copay accumulators.

Now that there is no doubt that the 2020 NBPP is now in effect, it must be followed. That rule states:

“Notwithstanding any other provision of this section, and to the extent consistent with state law, amounts paid toward cost sharing using any form of direct support offered by drug manufacturers to enrollees to reduce or eliminate immediate out-of-pocket costs for specific prescription brand drugs that have an available and medically appropriate generic equivalent are not required to be counted toward the annual limitation on cost sharing (as defined in paragraph (a) of this section) 45 C.F.R. § 156.130(h)(1).”

As HHS explained in adopting the rule: “Where there is no generic equivalent available or medically appropriate,” manufacturer assistance “must be counted toward the annual limitation on cost sharing” 84 Fed. Reg. at 17,545.

We request that you urge DOL and other agencies to issue guidance reminding plans that the 2020 NBPP rule is now in effect and must be followed. Additionally, all regulators must enforce the requirements.

We also urge the Committee to conduct a hearing on the Help Ensure Lower Patient Copays Act (HELP Copays Act: H.R. 830) that ensures that copay assistance is credited as patient out-of-pocket costs. It now enjoys broad bipartisan support with 117 cosponsors.

The Committee should also conduct hearings on employers and insurance plans that continue to engage in these abuses.

Covered Drugs Must be Included as Essential Health Benefits

After raising this issue for many years, we are pleased that CMS is finally taking steps to clamp down on insurers and employers that are abusing the Affordable Care Act by covering drugs without including them as part of essential health benefits. We are now calling upon the tri-agencies, including the Departments of Labor and Treasury, to clarify that this abuse is not allowed in ERISA plans and ask Congress to support us in this request.

CMS proposed in the draft 2025 Notice of Benefit and Payment Parameters rule to codify its existing policy, in place since 2016, that plans covering prescription drugs in excess of the state’s benchmark plan are considered essential health benefits (EHB) and therefore are subject to EHB protections, including annual cost-sharing limits. CMS would accomplish this by proposing to amend § 156.122 to add paragraph (f), which would explicitly state that drugs in excess of the benchmark are considered EHB. We support this change.

In recent years, some insurers and employers have been abusing the system by covering drugs but classifying them as “non-EHB,” and forcing patients to obtain their prescription drugs outside the protections included in the ACA. Payers and vendors who use this scheme also are implementing copay maximizers by exploiting copay assistance from drug manufacturers far in excess of the annual amount payers are entitled to.

Those entities implementing these schemes have not hidden what they are doing.

One of the companies, SaveOnSP, which is working with the PBM Express Scripts (which is owned by the insurer Cigna), explains on its website in a FAQ titled “How will plan sponsors see savings generated?”

The plan sponsor will experience savings by leveraging the Affordable Care Act state benchmark requirements to classify certain specialty medications under the category of non-essential health benefits. These medications will not accumulate toward the plan participant’s deductible or out-of-pocket maximums. This allows higher cost-sharing to apply to the medications and a lower overall cost paid by the plan.

SaveOnSP explains that they help “plan participants save money on their specialty medications by supporting their enrollment in manufacturer copay assistance” and “support[] plan participants on more than 300 medications in approximately 20 therapy classes.”

Express Scripts is very up front on what they are doing and their work with SaveOnSP:

“Patients need their specialty medications, and plans need better affordability. In partnership with SaveOnSP on the first non-essential health benefits copay assistance solution, we’ve driven significant savings by targeting high-cost, high-volume drugs. SaveOnSP utilizes plan-design changes to identify select drugs as non-essential health benefits, enabling maximum savings and reducing plan and member costs.”

The list of drugs that SaveOnSP covers, as stated above, is quite extensive. For 2024 the list can be found here and includes 392 drugs.

That document explains how they operate and that beneficiaries, who already have insurance, must sign up for their program, and then, they will experience reduced costs. If they do not, they will have to pay 30 percent co-insurance. They also state they will seek copay assistance from the drug manufacturer. “By completing the manufacturer copay assistance program’s enrollment process and consenting to SaveOnSP monitoring your pharmacy account, your final cost will be reduced.”

Another company, PrudentRx, which works with the PBM CVS Caremark (which is owned CVS Health, which also owns insurer Aetna), works with self-funded plans and designates as non-essential health benefits over 500 drugs that impact over 50 groups of health conditions. They then force beneficiaries to sign up for their program so that they can extract copay assistance from the drug manufacturers. If beneficiaries sign up, the cost of the drug would be $0, but if they do not, they would be forced to pay a 30 percent co-insurance.

It is rather ironic that while there are entities (including insurers) that are voicing strong opposition to copay assistance, at the same time they are working with others that are taking advantage of the copay assistance programs and extracting as much as they can for themselves.

In documents sent to beneficiaries enrolled in plans that use PrudentRx, their entire program is fully described: for the Commonwealth of Kentucky, this is what their beneficiaries receive; and for the Catholic Diocese of Columbus, they receive this explanation.

Insurers also use PrudentRx. PacificSource, which operates in Montana, Oregon, Idaho, and Washington State, uses PrudentRx. In its Health Plans Drug List for Montana, they identify 798 medications as “Prudent” and that “are available on a copay maximizer program, available to select self-insured large groups only.”

Another company called Copay Armor, powered by PillarRx Consulting, according to plan documents in the Highmark Blue Cross Blue Shield system, “helps to leverage manufacturer assistance dollars to lower your prescription out-of-pocket costs. Copay Armor is driven off a unique drug list of high cost mostly specialty medications that utilize manufacturer assistance dollars.” They include a long list of 171 drugs, including numerous HIV and hepatitis drugs.

Variable Copay explains how it works in this manner, “With Variable Copay™, members’ out-of-pocket costs for prescription drugs may be reduced or eliminated by a drug manufacturer’s coupon and the remaining drug coupon dollars are used to offset the costs to the employer.”

We are pleased that the federal government is beginning to crack down on this abuse of the ACA and urge Congress to request that the tri-agencies clarify that the regulation stating that all covered drugs are EHB and pertains to all plans that follow EHB, including large group and self-insured plans, in order to put an end to these flagrant abuses of the ACA.

Alternative Funding Programs

In addition to entities that designate “non-EHB drugs” for the use of extracting manufacturer copay assistance in order to implement copay maximizers, there are other vendors that work with employers that also use “non-EHB drug” designations to implement alternative funding programs. In these programs, patients who use certain medications are directed to enroll in an alternative program, which is not insurance, in order to bypass ACA laws and regulations relative to patient cost-sharing limits and other patient protections. They then find alternative funding mechanisms to pay for the drugs. If the patient does not comply, they will be left paying the full cost of the drug.

One such company called SHARx used to be more upfront in how it works. While they still state that they are not insurance (thereby bypassing federal and state regulations) and “advocate for the procurement of these medications through many different access points,” they no longer list on their website what those avenues are. However, as we indicated in our comments on the 2024 NBPP proposed rule, they included, “manufacturer free programs, grants/charities, our International Mail Order Pharmacy partner, domestic wholesale pharmacy and occasionally a copay card.”

Another company, Payer Matrix, works in a similar fashion, and “make[s] 300+ medications available to a wide range of employees and patients” by partnering up with employers and their employees, who are insured, but force them to sign up for Payer Matrix. If they do not, they are forced to pay for the full cost of the drug. The vendor then signs up for drug manufacturers patient assistance programs, which are free drug programs meant for people who are uninsured.

While some of this information is no longer available on their website, it still includes an FAQ titled, “Do I have to provide financial information?” That is answered by the following: “Financial information may be required at times as part of the application process if there is an income threshold requirement for the manufacturer. Not all manufacturers request financials on the application.” This makes it clear what the company is doing.

There are a growing number of other vendors that are working with insurers, employers, and PBMs around the country. In addition to SHARx and Payer Matrix, here is a list that was compiled by Dawn Holcombe of the Connecticut Oncology Association:

https://www.rxfree4me.com/#home

https://www.veracity-benefits.com/veracityrx/[9]

We urge the Congress to investigate these harmful schemes and pass legislation outlawing them, if the federal government does not stop them on its own.

Prevalence of Plans Using Non-EHB Drug Designations

To determine how common these practices are, we spent a couple of hours conducting searches on the web for employers and plans that use these vendors for their prescription drug coverage. As detailed in Attachment 1, the HIV+Hepatitis Policy Institute compiled a list of over 100 employers across the country including large private companies, universities, state and county governments, unions and non-profits, along with 22 insurers. Not all health plans are made public, particularly those of private employers, so the search results, we assume, are limited.

While the full list is in Attachment 1, employers who are using or have used vendors that are forcing their employees as part of their insurance benefit to enroll with vendors to obtain certain “non-essential health benefit” prescription drugs and then seek copay assistance from drug manufacturers or alternative funding, include the following:

Large Employers: Bank of America, Chevron, Citi, Delta, Hertz, Hilton, Home Depot, NewsCorp, Ruby Tuesday, Target, and United Airlines

States: Connecticut, Delaware, Kansas, Kentucky, and New Mexico

Counties: King County (WA), Mendocino County (CA), Orange County (FL), Sanilac County (MI), San Luis Obispo County (CA)

School Districts: Missouri Educators United Health Plan, Sarasota County Schools, State Teachers Retirement System of Ohio, and Teacher Retirement System of Texas

Universities: Baylor, Carnegie Mellon, Duke, George Washington, Harvard, Kent State, New York University, Ohio State, Purdue, University of California, Yale, and Yeshiva

Unions: New York Teamsters, Screen Actors Guild, Vancouver Firefighters Union, and Writers Guild

Other Non-profits: Catholic Diocese of Columbus, Cleveland Clinic, and Nemours Children’s Health

In addition, we found 22 insurers that include: Blue Cross Blue Shield Massachusetts, Blue Cross Blue Shield of Western New York, Christian Brothers Services, Guidestone Health Insurance, Health Alliance Plan (MI), Johns Hopkins, Medical Mutual of Ohio, Members Health Plan NJ, Premera Blue Cross, Priority Health (MI) and Wellmark BlueCross Blue Shield (Iowa and South Dakota).

While we realize that this quick search does not provide a complete picture, there have been some statistics compiled on the use of maximizers, which utilize the non-EHB scheme.

According to IQVIA, in 2021, 45 percent of covered lives in commercial plans were in plans with maximizers.

Also, according to IQVIA data, presented below, of the $18.7 billion provided annually by copay assistance, $2.6 billion of that was subject to maximizers, which utilize the “non-EHB” scheme (while another $3.5 billion was subject to copay accumulators.) [10]

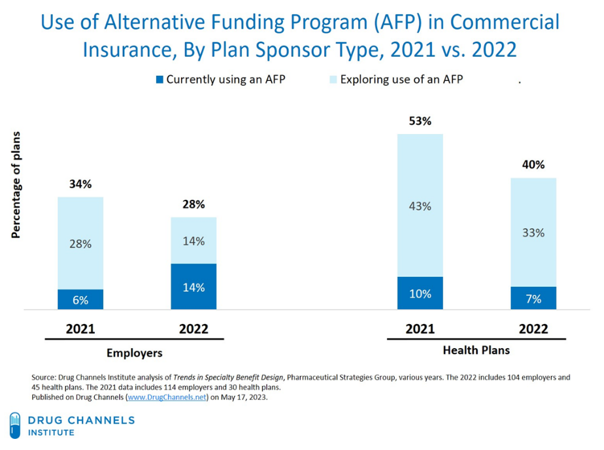

As described in the graph below, according to Adam Fein of Drug Channels, in a survey of employers and plans, in 2022, 14 percent of employers were using Alternative Health Programs, while another 14 percent were exploring their use. Among plans, 7 percent were using them, while another 33 percent were exploring their use.

We believe, based on this data presented, the use of designating covered drugs as non-EHB is extremely widespread and is growing. This practice must be stopped across all commercial insurance markets.

Discriminatory Benefit Design Should Not Be Permitted

Finally, we wish to express our concern about discriminatory benefit designs among ERISA plans. We call on you to conduct oversight over the employer plans and urge the Department of Labor to better enforce existing requirements to ensure that medications are included on formularies and that employees and their families are not harmed by excessive utilization management, discriminatory tiering, and contraventions of ACA preventive services cost-sharing requirements.

We continue to hear from employees and their families concerning health insurance plans that discourage enrollment by people living with or at risk for HIV by placing most or all drugs used under currently accepted treatment guidance and best practice for HIV treatment and prevention drugs on high-cost tiers. We have encountered other plans that simply do not cover most of the regimens recommended in current treatment guidelines for HIV. The insurance complaint process is lengthy and time-consuming, and we often do not hear back from regulators in a timely manner. Insurers seem to be able to get away with what they can until they are caught. And, even when they are caught, they can continue to violate the law. This is not what patients expect from their health insurance coverage. We urge the Department of Labor to be more proactive and take decisive enforcement action against employers that violate the law, levy appropriate penalties, and publicize the reviews and actions taken.

Under the ACA, all non-grandfathered commercial insurance plans are required to cover preventive services approved by the USPSTF, including HIV and hepatitis B and C testing and PrEP, which are drugs that prevent HIV. Despite federal and state guidance and legislation, non-compliance is still widespread, resulting in PrEP discontinuation, and, in some cases, the acquisition of HIV. We ask that you conduct oversight on the implementation of this important component of the ACA and urge the Department of Labor to better enforce these important protections.

We thank you for the opportunity to share these comments and look forward to working with you as you seek to make healthcare more affordable and accessible to America’s employees and their families. Should you have any questions or comments, please feel free to contact me at cschmid@hivhep.org. Thank you very much.

Sincerely,

Carl E. Schmid II

Executive Director

Attachment

[1] https://www.healthsystemtracker.org/chart-collection/trends-in-employer-based-health-coverage/.

[2] We have submitted comments on these benefit designs and related topics to CMS on the Notice of Benefits and Payment Parameters for 2025 proposed rule, as well as on the 2025 Draft Letter to Issuers in the Federal-facilitated Exchange, which can be found here.

[3] “The Use of Medicines in the U.S. 2022: Usage and Spending Trends and Outlook to 2026,” IQVIA Institute, April 2022, https://www.iqvia.com/-/media/iqvia/pdfs/institute-reports/the-use-of-medicines-in-the-us-2022/iqvia-institute-the-use-of-medicines-in-the-us-2022.pdf, page 40.

[4] “The Use of Medicines in the U.S. 2022,” page 41.

[5] Sara R. Collins, Shreya Roy, Relebohile Masitha. “Paying for It: How Health Care Costs and Medical Debt Are Making Americans Sicker and Poorer,” Findings from the Commonwealth Fund 2023 Health Care Affordability Survey, October 26, 2023, https://www.commonwealthfund.org/publications/surveys/2023/oct/paying-for-it-costs-debt-americans-sicker-poorer-2023-affordability-survey?check_logged_in=1&utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosvitals&stream=top.

[6] “Plan Year 2024 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces,” CMS, last modified 10/25/23, https://www.cms.gov/files/document/2024-qhp-premiums-choice-report.pdf.

[7] “National Health Expenditure Data,” CMS, last modified 12/13/23, https://www.cms.gov/data-research/statistics-trends-and-reports/national-health-expenditure-data/nhe-fact-sheet#:~:text=NHE%20grew%204.1%25%20to%20%244.5,18%20percent%20of%20total%20NHE.

[8] “The Use of Medicines in the U.S. 2022,” IQVIA Institute, April 2022, https://www.iqvia.com/-/media/iqvia/pdfs/institute-reports/the-use-of-medicines-in-the-us-2022/iqvia-institute-the-use-of-medicines-in-the-us-2022.pdf, page 47.

[9] Dawn Holcombe, “Understand the Nuances and Impact of Alternate Funding Programs,” National Oncology State Network (PowerPoint Presentation, Copay, Reimbursement and Access Congress, 10/2/23).

[10] Luke Greenwalt, “Summiting the Next Decade—Finding Success on a Difficult Climb,” IQVIA Market Access Center of Excellence (PowerPoint presentation, Payers, Patients, Pharmacies, & Pressure: State of the Payer 2023, 5/1/23).

Attachment 1

Plans & Issuers Using “Non-EHB” Prescription Drug Vendors

Compiled by HIV+Hepatitis Policy Institute

January 8, 2024

- Private sector employers

- BAE Systems https://info.caremark.com/oe/baesystems (PrudentRx)

- Bank of America https://www.bankofamerica.com/content/documents/employees/abe_aug_2024_announcement_article.pdf (Prudent Rx)

- Chevron https://hr2.chevron.com/-/media/hr2/document-library/smm/smm_2023_rxexpressscripts_saveonsp_medppo_final.pdf (SaveOnSP)

- Citibank https://www.citibenefits.com/Health/Prescription-Drugs (PrudentRx)

- Delta Airlines https://deltabenefits.com/# (Prudent Rx)

- Hertz https://hertzbenefits.com/wp-content/uploads/UMR-SPD-2020-2021.pdf (Archimedes)

- Hilton https://cache.hacontent.com/ybr/R516/01250_ybr_ybrfndt/downloads/HiltonUSSPDEnglish.pdf (Prudent Rx)

- Home Depot https://www.caremark.com/portal/asset/HomeDepot_Base_BAAG.pdf (Prudent Rx)

- JCrew https://mybenefits.aon.com/getmedia/2904e963-11e4-461b-aa40-e583cf498074/2023_Benefits_Guide.pdf (ImpaxRx)

- Marathon Petroleum Company https://www.mympcbenefits.com/Documents/MPC-2023-Saveon-Program-Medication-List-Classic-Plan.pdf (SaveOnSP)

- Montana’s Credit Unions https://www.mcun.coop/wp-content/uploads/2023/04/MCULSmithRx_Connect-Patient_Assistance_Program.pdf (Smith Rx)

- NewsCorp https://mynewscorpbenefits.com/news-corp/prudentrx-opportunities-to-save-on-specialty-rx/ (Prudent Rx)

- Potlatch #1 Financial Credit Union (Idaho) https://fliphtml5.com/nwekg/uawj/basic (Payer Matrix)

- Publicis Group https://www.publicisconnections.com/Health-Benefits/-/media/Mercer/Publicis/Documents/PrudentRx_Specialty_Medication_Copay_Program_FAQs.pdf (Prudent Rx)

- Ruby Tuesday https://benefits.rubytuesday.com/pdf/PayerMatrixMemberLeaveBehind_100122_vF.pdf (Payer Matrix)

- Target https://www.express-scripts.com/files/hub/art/open_enrollment/TargetBenOverview.pdf (SaveOnSP)

- Truist Financial https://benefits.truist.com/benefits/pharmacy (Prudent Rx)

- United Airlines https://cache.hacontent.com/ybr/R516/00245_ybr_ybrfndt/downloads/254455.pdf (Prudent Rx)

- States

- Connecticut https://carecompass.ct.gov/wp-content/uploads/2022/04/PrudentRx_OptOut.pdf (Prudent Rx)

- Delaware https://dhr.delaware.gov/benefits/cvs/documents/prudentrx/faq.pdf (Prudent Rx)

- Iowa https://das.iowa.gov/media/3883/download?inline= (Prudent Rx)

- Kansas https://sehp.healthbenefitsprogram.ks.gov/media/cms/2024_Enrollment__Presentation__09_d17de44190c92.pptx (Prudent Rx)

- Kentucky https://extranet.personnel.ky.gov/KEHP/PrudentRx%20Overview.pdf (Prudent Rx)

- New Mexico https://www.mybenefitsnm.com/documents/CVS_and_HR_Reminders.pdf (Prudent Rx replacing SaveOnSP)

- West Virginia Public Employees Insurance Agency https://peia.wv.gov/forms-downloads/prescription-drug-benefits/Pages/default.aspx (SaveOnSP)

- Counties

- Cherokee County GA https://cherokeecountyga.gov/Human-Resources/_resources/documents/US-Rx%20Care_Prescription%20Drug%20Navigation%20Guide%20-%20SS%20w%20International%202023_v.1.pdf (Script Sourcing, importation)

- Clermont County OH https://hr.clermontcountyohio.gov/prescription-plan/ (Payd Health)

- Dunn County WI https://vendornet.wi.gov/Download.aspx?type=bid&Id=54a11329-5ad2-ed11-9043-00505684483d&filename=Appendix+B+-+2023+Dunn+County+Benefit+Booklet.pdf (Scout Rx)

- King County WA https://kcemployees.com/2023/12/18/save-100-on-specialty-medications-with-prudentrx/ (Prudent Rx)

- Mendocino County CA https://www.mendocinocounty.org/government/executive-office/health-insurance-plan/prescription-coverage (SaveOnSP)

- Orange County FL https://www.orangecountyfl.net/Portals/0/resource%20library/employment%20-%20volunteerism/2024MedicalBenefits/SaveOnSP.pdf (SaveOnSP)

- Sanilac County MI https://www.sanilaccounty.net/Handlers/File.ashx?ID=204727 (SHARx)

- San Luis Obispo County CA https://www.slocounty.ca.gov/Departments/Human-Resources/Employee-Benefits/Pharmacy/Pharmacy-Benefits/SaveOnSP.aspx (SaveOnSP)

- Summit County OH https://hreb.summitoh.net/files/6519/meeting_file/openenrollmentguide.pdf (SaveOnSP, ImpaxRx)

- Tehama County CA https://www.co.tehama.ca.us/wp-content/uploads/2022/04/Save-on-SP.pdf (SaveOnSP)

- Tulare County CA https://tularecounty.ca.gov/hrd/benefits-wellness/pharmacy/variable-co-pay-assistance-program/ (EmpiRx Variable Copay Assistance Program)

- Waukesha County WI https://www.waukeshacounty.gov/globalassets/administration/human-resources/benefits/true-rx-spd-waukesha-county-002.pdf (ShaRx)

- Cities and other local jurisdictions

- Cheyenne WI https://cheyenne.granicus.com/MetaViewer.php?view_id=5&event_id=1142&meta_id=123138 (Payd Health)

- Columbus GA https://www.columbusga.gov/Portals/HR/pdfs/DPS%20Flyer.pdf (ImpaxRx)

- New Jersey State League of Municipalities https://www.njlm.org/DocumentCenter/View/8097/111919-0345-rxcostdriverspart2 (SaveOnSP)

- Village of Lake Zurich IL https://lakezurich.org/DocumentCenter/View/11785/SaveonSP-Overview-and-FAQs?bidId= (SaveOnSP)

- School Districts and Teacher Retirement Plans

- Arizona School Boards Association Insurance Trust https://content.myconnectsuite.com/api/documents/72c88ea8876746b7b21a1b51edeb43a1.pdf (PrudentRx)

- Clovis Unified School District https://www.cusd.com/Downloads/PrudentRx%20Program%20Specialty%20Drug%20Complete%20List%20(1).pdf (Prudent Rx)

- Menasha Joint School District WI https://doa.wi.gov/School%20District%20Health%20Ins%20Attachments/2021-22%20Menasha%20Joint%20Benefits%20Summary.pdf (ScoutRx)

- Missouri Educators Unified Health Plan (MEUHP) http://meuhp.com/media/20100/saveonsp%20broker%20client%20flyer.pdf (SaveOnSP; Cigna Plan)

- Osceola County FL School District https://www.osceolaschools.net/cms/lib/FL50000609/Centricity/Domain/156/ElectRx%20International%20Mail%20Order%20Program.pdf (Elect Rx, importation)

- Pinellas County Schools FL https://www.pcsb.org/Page/37275 (Prudent Rx)

- Ripon Area School District (WI) https://www.ripon.k12.wi.us/cms_files/resources/2023%20Benefit%20Guide%20(5).pdf (Scout Rx)

- Sarasota County Schools https://www.sarasotacountyschools.net/cms/lib/FL50000189/Centricity/Domain/1148/High%20PPO%20Plan%203769%20RX%20SBC%201-1-2024%20Rev.%20FINAL.pdf (SaveOnSP)

- State Teachers Retirement System of Ohio https://www.strsoh.org/_pdfs/health-care/saveonsp.pdf (SaveOnSP)

- Teacher Retirement System of Texas https://www.trs.texas.gov/TRS%20Documents/faq-prudentrx.pdf (Prudent Rx)

- Universities

- Barton Community College https://docs.bartonccc.edu/humres/HRBenefits%20and%20Discounts/Benefits/Health%20Plan%20Open%20Enrollment%20Links/BCCC%20Payer%20Matrix%20Overview%20%20FAQs%20-Combined%20(002).pdf (Payer Matrix)

- Baylor University https://hr.web.baylor.edu/sites/g/files/ecbvkj1046/files/2023-03/prudentrx_copay_optimization.pdf (Prudent Rx)

- Brown University https://www.brown.edu/about/administration/human-resources/benefits/health-and-wellbeing/prescription-drug-coverage (Pillar Rx)

- Butler University https://www.butler.edu/wp-content/uploads/sites/14/2022/01/paydhealth_select_drugs_and_products_program_member_mrx1346_0420-3.pdf (Payd Health)

- Carnegie Mellon University https://www.cmu.edu/hr/benefits/health-welfare/prescription/prudent-rx.html (Prudent Rx)

- Duke University https://hr.duke.edu/benefits/medical/pharmacy/ (SaveOnSP)

- George Washington University https://hr.gwu.edu/prudent (Prudent Rx)

- Harvard Universityhttps://hughp.harvard.edu/prescriptions (Pillar Rx)

- Hendrix College https://www.hendrix.edu/uploadedFiles/Campus_Resources/Human_Resources/Benefits_Info/2024%20Health%20Benefit%20Overview.pdf (Payer Matrix)

- Illinois Institute of Technologyhttps://www.iit.edu/sites/default/files/2021-07/prudent-rx-participant-qa.pdf (Prudent Rx)

- Iona University https://www.iona.edu/offices/human-resources/employee-benefits/health-insurance/saveonsp-variable-copayments-certain (SaveOnSP)

- Ithaca College https://www.ithaca.edu/intercom/2023-11-03-prudent-rx-update-and-open-enrollment-resources (use of Prudent Rx paused)

- Kent State University https://www.kent.edu/hr/benefits/prescription-cvs-health (Prudent Rx)

- Loyola University of New Orleans https://finance.loyno.edu/sites/default/files/2023-10/2024%20Loyola%20Benefits%20Guide.pdf (Payer Matrix)

- Missouri Southern State Universityhttps://www.mssu.edu/business-affairs/human-resources/2023-MSSU_Benefit-Guide_FULL-TIME_20230101.pdf (Payer Matrix)

- Northwestern University https://hr.northwestern.edu/benefits/health-insurance/health-insurance-plans/prescription-drug-benefits/ (SaveOnSP)

- New York University https://www.nyu.edu/employees/benefit/full-time/professional-research-staff/benefits-guide-2023/prescription-drug-plan/prudentrx-specialty-medication-program.html (Prudent Rx)

- Northwestern University https://hr.northwestern.edu/benefits/health-insurance/health-insurance-plans/prescription-drug-benefits/ (SaveOnSP)

- Oakland University https://www.oakland.edu/Assets/Oakland/uhr/files-and-documents/2022-Benefits/2022%20OU%20Guide%20Faculty_final.pdf (Pillar Rx)

- Ohio University https://www.ohio.edu/hr/benefits/prescription-drug-coverage (Prudent Rx)

- Ohio State University https://hr.osu.edu/wp-content/uploads/rx-saveonsp-list.pdf (SaveOnSP)

- Princeton University https://hr.princeton.edu/sites/g/files/toruqf1976/files/documents/2022-SPD-prescription-drug-plan.pdf (OptumRx Variable Copay Solution)

- Purdue University https://www.purdue.edu/hr/Benefits/prescription/ (Archimedes)

- Texas A&M Universityhttps://www.tamus.edu/business/prescription-programs-and-your-am-system-prescription-drug-benefits/ (SaveOnSP)

- University of Alaska https://www.alaska.edu/hr/benefits/documents-and-forms/pharmacy/2021saveonsp-drug-list.pdf (SaveOnSP)

- University of Californiahttps://ucnet.universityofcalifornia.edu/forms/pdf/2023_uchsp-rx-booklet.pdf (Lumicera/Navitus)

- University of Connecticut https://hr.uconn.edu/wp-content/uploads/sites/1421/2022/05/2022-SEBAC-Agreement.pdf (Prudent Rx)

- University of Pittsburgh https://www.hr.pitt.edu/sites/default/files/PrescriptionDrugFAQ.pdf (SaveOnSP)

- University of Richmondhttps://hr.richmond.edu/benefits/insurance/medical-plans/pdf/SaveonSP.pdf (SaveOnSP)

- University of Wisconsin https://www.wisconsin.edu/ohrwd/benefits/health/pharmacy-benefits/ (Navitus/Lumicera)

- Villanova University https://www1.villanova.edu/content/dam/villanova/hr/documents/SBC-23-24%20PPO%20Villanova%20University.docx (SaveOnSP)

- Washington University in St. Louis https://hr.wustl.edu/benefits/medical-dental-life/prescription-drug-benefit/ (SaveOnSP)

- Yale University https://your.yale.edu/work-yale/benefits/benefits-enrollment-2024/managerial-and-professional-benefits-2024 (Prudent Rx)

- Yeshiva https://www.yu.edu/sites/default/files/inline-files/Yeshiva%202021%20OE%20Presentation_Final%20%28003%29.pdf (Prudent Rx)

- Unions

- ATU 1181 (NY) https://atu1181.org/wp-content/uploads/2019/04/Active-SBC-4-15-19-12-31-19.pdf (Payer Matrix)

- Food Employers Labor Relations Association and United Food and Commercial Workers VEBA Fund https://www.associated-admin.com/images/pdf/FELRA/FELRA%20SMM%20re%20COVID-19%20and%20SaveOn%203.23.2020.pdf (SaveOnSP)

- International Association of Machinists and Aerospace Workers https://www.iambtf.org/medical-prescriptions/prudentrx-copay-program (Prudent Rx)

- New York Teamsters https://nytfund.org/media/jdedv5pz/20211122-saveonsp-drug-list-effective-01012022.pdf (SaveOnSP)

- Screen Actors Guild https://www.sagaftraplans.org/health/cvs-specialty (Prudent Rx)

- Sprinkler Fitters of Chicago https://sprinklerfitterchicago.org/ULWSiteResources/ualocal281_v2/Resources/file/health-welfare/documents/smm-21.pdf (Payd Health)

- Tri-County Building Trades Health Fund (MI, OH, WV) https://www.ourbenefitoffice.com/SheetMetalWorkers33/Benefits/Module/Member/MaintFileUploadPopup.aspx?fileUploadID=zLAQ7vZg2Rs%3D (Payd Health)

- Vancouver Firefighters Union (WA) https://www.vanfiretrust.org/payer-matrix.html (Payer Matrix)

- Writers Guild https://www.wgaplans.org/saveonsp/ (SaveOnSP)

- Other non-profit organizations

- Broward Health, FL https://employee.browardhealth.org/-/media/broward-health/employee/benefits/prudentrx-frequently-asked-questions.pdf (Prudent Rx)

- Catholic Diocese of Columbus https://columbuscatholic.org/system/resources/W1siZiIsIjIwMjEvMTAvMTkvMWxrM2diNjFkeV9BRVROQV9QcnVkZW50X1J4X0FtZW5kbWVudF85LjEuMjEucGRmIl1d/AETNA%20Prudent%20Rx%20Amendment%209.1.21.pdf (Prudent Rx)

- Cleveland Clinic https://employeehealthplan.clevelandclinic.org/Home/Resources/Specialty-Drug-Copay-Card-Assistance-Programs (Prudent Rx)

- Nemours Children’s Health https://nemoursbenefitsguide.com/wp-content/uploads/2022/12/2023-Rx-Plan-overview-Nemours.pdf (SaveOnSP)

- Lake Metropolitan Housing Authority https://digital.nfp.com/vlp/Lake%20Metropolitan%20Housing%20Authority%20Landing%20Page (ImpaxRx)

- Issuers

- Advantage Health Plans (TX, OK) https://www.advantagehealthplans.com/pdf/AHP%20Southern%20Scripts%20Variable%20Copay.pdf (Southern Scripts Variable Copay Program)

- Blue Cross Blue Shield of Kansas https://benefits-direct.com/ottawa290/wp-content/uploads/sites/81/2023/09/FlexAccess-member-flyer-2023.pdf (FlexAccess)

- Blue Cross Blue Shield of Massachusetts https://home.bluecrossma.com/collateral/sites/g/files/csphws1571/files/acquiadam-assets/Cost%20Share%20Assistance%20Medication%20List.pdf (Pillar Rx)

- Blue Cross Blue Shield of Michigan https://www.bcbsm.com/amslibs/content/dam/public/employers/documents/share-resources-employees/individual-files/high-cost-drug-discount-program.pdf (Pillar Rx)

- Blue Cross Blue Shield of Minnesota https://www.bluecrossmn.com/sites/default/files/DAM/2022-09/2023_RX-Fact-Sheet_AGCS%2BMedsYourWay_91922.pdf (FlexAccess)

- Blue Cross Blue Shield of Nebraska https://www.nebraskablue.com/-/media/Files/NebraskaBlueDotCom/Shop-Plans/Group-Health-Plans/Large-Group-Plans/PremierBlue_Plan_Options_92106.pdf (FlexAccess)

- Blue Cross Blue Shield of Western New York https://www.bcbswny.com/content/dam/BCBSWNY/broker-group/public/pdf/group/computer-task-group/Saveon-Member-Flyer.pdf (SaveOnSP)

- Chorus Community Health Plans (Wisconsin) https://chorushealthplans.org/getmedia/87931284-9823-4cef-b6b0-75fba6b587ec/Chorus-Gold-SOB-2024-(Rev-2023-06-12).pdf (SaveOnSP)

- Christian Brother Services https://www.cbservices.org/assets/images/health/health_benefit_flyers/H&B_SaveonSP%20Program.pdf (SaveOnSP)

- EMI Health (offers medical insurance to corporate, government, public education, and higher education groups in Arizona, Georgia, Texas, and Utah) https://emihealth.com/pdf/saveon.pdf (SaveOnSP)

- Guidestone Health Insurance https://www.guidestone.org/-/media/Insurance/LifeConversionForms/Express-Scripts-SaveonSP-Medication-List (SaveOnSP)

- Health Alliance Plan (MI) https://www.hap.org/-/media/project/hap/hap/files/hap/prescription/2024/2024-copay-assistance-program-for-hap-members-flyer.pdf (SaveOnSP)

- Johns Hopkins https://www.hopkinsmedicine.org/johns-hopkins-health-plans/providers-physicians/our-plans/ehp/pharmacy-formulary (Prudent Rx)

- Medical Mutual of Ohio https://www.medmutual.com/-/media/88221371697746DA9E847850C2B8754A.ashx?h=16&thn=1&w=16 and https://www.buaweb.com/files/63123/the_file/saveonsp_flyer_c3116rxx_422.pdf (SaveOnSP)

- Members Health Plan NJ https://membershealthplannj.com/wp-content/uploads/2019/12/2019-SaveOn-list.pdf (SaveOnSP)

- Network Health Insurance Plans (Wisconsin) https://networkhealth.com/__assets/pdf/pharmacy/saveon-drug-list.pdf (SaveOnSP)

- Pacific Source Health Plans (MT, OR, ID, WA) https://pacificsource.com/ps_find_drug/pdf/MT/2024(Prudent Rx copay maximizer, see p2)

- Premera Blue Cross https://www.premera.com/documents/052560.pdf (SaveOnSP)

- Priority Health (MI) https://www.priorityhealth.com/individual-family-health-insurance/learning-center/mypriority-plan-benefits (SaveOnSP)

- University of Pittsburgh Medical Center Plans https://www.upmchealthplan.com/aon/pharmacy.aspx (SaveOnSP)

- Wellmark BlueCross Blue Shield (Iowa and South Dakota) https://www.wellmark.com/-/media/sites/public/files/member/prudentrx-drug-list.pdf?sc_lang=en&hash=D71214E333698A85351498D5E6CB4D57 (Prudent Rx)

- Wisconsin Physicians Service Insurance Corporation https://secure.wpsic.com/sales-materials/files/35618-wps-aso-esi-specialty-drug-program.pdf (SaveOnSP)