Comments on notice of benefit and payment parameters proposed for 2022 rule: CMS 9914-P

Department of Health and Human Services

Attention: CMS 9914 P

P.O. Box 8016

Baltimore, MD 21244 8016

To Whom it May Concern:

The HIV+Hepatitis Policy Institute, a national, non-profit organization whose mission is to promote quality and affordable healthcare for people living with or at risk of HIV, hepatitis, and other serious and chronic health conditions, is pleased to submit comments on the proposed Notice of Benefit and Payment Parameters for 2022 (NBPP) rule. Our comments primarily pertain to the lack of attention in the proposed rule to address patient cost-sharing requirements as it relates to drug manufacturer coupons. Additionally, we comment on 1) Risk Adjustment; 2) Prescription Drug Rebates & Medical Loss Ratio Requirements; and 3) PBM and Insurer Drug Distribution and Cost Reporting. HIV+Hep is a member of the HIV Healthcare Access Working Group (HHAWG) and has signed onto its comment letter, which focuses on many other issues contained in the proposed rule.

Copay Assistance Must Count and Transparency is Needed

HIV+Hep is extremely disappointed that the draft NBPP does not address the important issue of copay assistance for prescription drugs. In the past, CMS has provided guidance to issuers on how they must treat drug manufacturer copay assistance. Unfortunately, it has been a series of contradictory decisions. After remaining silent for years while these practices were being implemented, the NBPP rule for 2020 directed insurers to count copay assistance towards a patient’s out-of-pocket maximum when there is no generic equivalent for a brand name drug or a person receives copay assistance for a brand drug when there is a generic that they receive through an appeals or exceptions process. However, after its finalization, CMS backed off from patients and insurers, along with state regulators.

At a time when the American people are rightfully complaining about how much they pay for prescription drugs, HIV+Hep cannot understand why CMS is not requiring insurers to count copay assistance towards beneficiaries’ out-of-pocket costs and deductibles. Copay assistance is particularly important during the COVID-19 epidemic when so many individuals and families are hurting economically. As described below, allowing insurers to implement copay accumulator policies actually allows them to “double dip” and collect more money from both patients and drug manufacturers.

HIV+Hep is urging CMS to include language in the final 2022 NBPP rule that reverts to the 2020 NBPP rule that requires insurers to count copay assistance, with limited exceptions. Additionally, as discussed below, CMS must require insurers to be transparent in how they address copay assistance.

Need for Copay Assistance: Patients are finding it harder to afford their medications. Insurers are designing health plans that require patients to shoulder higher deductibles and place more drugs on tiers with high coinsurance. In order to afford their medications, patients must rely on assistance from manufacturers.

For plan year 2022, CMS is proposing that the maximum out-of-pocket be $9,100 for an individual and $18,200 for all others. This represents an increase of 6.4 percent over 2021. Due to the proliferation of high deductible plans, depending on the drug, a patient may be required to pay that total amount of $9,100 all at once for their medication at the beginning of the year. Even if it were much less than that, patients still have trouble affording their medications.

While it would be beneficial to have first dollar coverage for prescription drugs and reasonable copays, issuers are moving in the opposite direction with higher deductibles and higher cost-sharing. According to a study conducted by Ezra Golberstein examining National Health Expenditure Accounts data, in 2017 individuals were responsible for paying 14 percent of the total cost of prescription drugs. However, for hospital care, which accounts for nearly three and half times more total spending, patients were responsible for paying only 3 percent. For physician and clinical services, the next largest service category, patients paid 8.5 percent of the costs. This is one reason why people are complaining about how much they pay for their medications; insurers are requiring them to pay a high percent of the total costs.

In addition, the number of high-deductible health plans is increasing. According to the Kaiser Family Foundation, average deductibles for covered workers increased 212% from 2008 to 2018. About 40 percent of beneficiaries with employer-sponsored coverage have a high-deductible plan with deductibles exceeding $1,500 for 20percent of them. For qualified health plans, CMS reports that across all metal levels, deductibles are increasing. For Bronze plans, the median deductible will be $6,992 in 2021, an increase of 11 percent from 2017; for Silver plans, it will be$4,879, an increase of 31 percent since 2017.

Due to these rising costs, patients must turn to copay assistance to afford their medications. According to the IQVIA National Prescription Audit, Formulary Impact Analyzer (January 2019), total out-of-pocket costs for prescription drugs was $74 billion in 2018. Of that amount, drug coupons amounted to $13 billion. Ensuring that this copay assistance counts is extremely important to patients’ affordability of and adherence to prescription drugs.

Plans should not be concerned with who pays the cost-sharing requirements. They still collect the money, whether it is from the beneficiary or the manufacturer. We have heard criticism that coupons steer patients to higher priced drugs. For many patients with serious and chronic illnesses who rely on high cost drugs, there are no generics or low-cost alternatives. Further, providers prescribe the medications that their patients need and do not select them on the basis of the existence of coupons. For people living with HIV, hepatitis, and many other serious and chronic conditions, all the competing manufacturers offer coupons so there is no steering to a particular drug.

Higher Cost-Sharing Leads to Lack of Adherence: According to the IQVIA National Prescription Audit, Formulary Impact Analyzer (January 2019)analysis of new starts of branded drugs, if patient out-of-pocket costs totaled between $50 and $74.99 per month, 30 percent of the patients would not pick up their medications. If that amount was increased to $250 or more, over 70 percent of patients would not pick up their drugs.

In another study by IQVIA, “Patient Affordability Part Two: Implications for Patient Behavior & Therapy Consumption” that examined in which phase of the benefit design did prescription drug abandonment occur, 17 percent were due to copays and 23 percent were in the coinsurance phase, while 41 percent were in the deductible phase. Clearly this demonstrates that high deductibles and high coinsurance are the top reasons why patients abandon their medications. Having copay assistance greatly decreases the chance of prescription abandonment. In that same study, IQVIA found that in 2017, 12 percent of patients abandoned their brand drugs included in their study, even if they had copay assistance. If there were no copay card support, the amount would increase to 31 percent.

According to Rx Crossroads by McKesson’s data and research, patients impacted by copay accumulator programs fill prescriptions 1.5 times less than patients in high deductible health plans. Additionally, patients subject to these programs experience a 13 percent drop in persistence between month 3 and 4 as they reach the cap in their annual benefits and drop off therapy.

Copay Accumulators Allow Insurers to “Double Dip”: Perhaps the most overlooked aspect of the “copay accumulator” debate is that not only do patients pay much more money for their prescription drugs, but the insurers also collect more money. The insurer not only collects the value of the copay coupon, but then after it is maxed, the patient then has to pay the out-of-pocket costs, with the insurer collecting all that money as well. Additionally, the drug manufacturers end up paying more money. The only players that this policy is good for are the insurers and the PBMs.

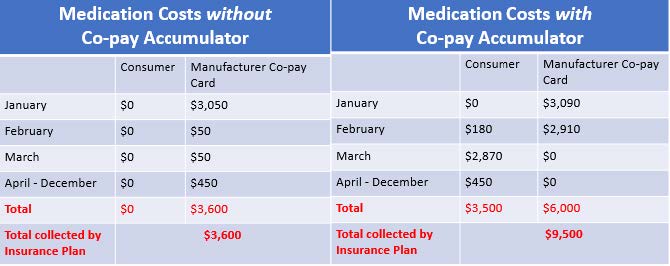

[Assumptions: Plan Deductible: $3,000; Drug Cost-Sharing: $50, after deductible; WAC price for drug: $3,090; Plan out-of-pocket maximum: $6,000; Manufacturer copay assistance annual maximum: $6,000. Patient scenarios were developed by NASTAD and adopted by The AIDS Institute.]

Above are two scenarios for a patient accessing a single tablet antiretroviral drug for the treatment of HIV. The scenario on the left is a patient in which copay assistance counts. The scenario on the right demonstrates how things change when copay assistance does not count. Under this scenario, the patient pays a total of $3,500 more over the course of one year, the drug manufacturer pays $2,400 more, and the plan receives $5,900 more by implementing a copay accumulator.

Growth of Copay Accumulator Programs: Without further action by federal and state governments, insurers and PBMs will continue to implement these programs and cause further harm to patients. We are thankful that five states (AZ,GA, IL, VA, WV) and Puerto Rico have passed laws that ensure copay assistance must count; however, they do not impact employer health plans, where the majority of people receive their health coverage. According to the National Business Group of Health, in the next two years, accumulators and maximizers are expected to expand from approximately 25 percent of U.S.employers to as many as 50 percent.

Trial card, one of the leading administrators of copay assistance programs, reports that the number of their clients who have patients taking infectious disease medications and are subject to copay accumulator programs increased from 7.3 in 2019 to 10.5 percent in 2020.

Need for Transparency

In the 2021 NBPP rule, CMS reminded issuers “to encourage transparency with regard to changes in how direct drug manufacturer support amounts count towards the annual limitation on cost-sharing. For example, we encourage issuers to prominently include this information on websites and in brochures, plan summary documents, and other collateral material that consumers may use to select, plan, and understand their benefits. If we find that such transparency is not provided, HHS may consider future rule making to require that issuers provide this information in plan documents and collateral material.”

Despite these warnings from CMS, a cursory review of 2021 qualified health plans by HIV+Hep reveals no difference in how insurers are displaying their copay accumulator policies. They continue to conceal them deep in plan documents and leave patients unaware of the increase in patient costs that they might be subject to. Additionally, there is no consistency among insurers on how the policies are displayed. Consider the following examples:

Arizona United Healthcare: Ambivalent language leaves beneficiary unsure of policy

Coupons: The value of any manufacturer coupons applied to member cost share may not apply to deductibles or total member out-of-pocket limits. The value will always apply for a prescription drug without a generic equivalent or that has been obtained through prior authorization, step therapy, or an exclusion exception, as described in this Prescription Drugs -Outpatient provision. (Medical Policy, page 45 of 58 page document)

Florida Blue: Ambivalent language leaves beneficiary unsure of policy

We may not apply manufacturer or provider cost share assistance program payments (e.g.,manufacturer cost share assistance, manufacturer discount plans, and/or manufacturer coupons) to the Deductible or Out-of-Pocket maximums. (Plan Contract, Summary of Benefits, page 47 of 144 page document)

Florida Ambetter: Mixing third-party premium policies and copay assistance using CMS policy as the reason

“…Ambetter payment policies were developed based on guidance from the Centers for Medicare and Medicaid Services (CMS) recommendations against accepting third party premiums… Similarly, if we determine payment was made for deductibles or cost sharing by a third party, such as a drug manufacturer paying for all or part of a medication, that shall be considered a third party premium payment that may not be counted towards your deductible or maximum out-of-pocket costs.” (Evidence of Coverage, page 32 of 95 page document)

Florida Molina: While Molina continues to be the only major issuer that includes the policy in their Summary of Benefits and Coverage, the language in that document is not consistent with their Drug Formulary document.

For brand drugs with a generic equivalent, coupons or any other form of third-party prescription drug cost-sharing assistance will not apply toward any deductibles or annual out-of-pocket limit. Summary of Benefits and Coverage

Notice on Drug Company Cost Sharing Assistance Cost Sharing paid with drug company support will not apply toward any Deductible or yearly Out-of-Pocket Maximum under your plan. Drug company support means discount cards, coupons, gift cards, cash or other financial help you get from the company or a sponsored program for the purpose of buying a company’s drugs. (Drug Formulary, page 2of 252 page document)

Georgia Anthem: In violation of state law, the plan uses ambivalent language and says it could change the policy at any time.

Drug Cost Share Assistance Programs: If You participate in certain drug Cost Share assistance programs offered by drug manufacturers or other third parties to reduce the Cost Share (Copayment, Coinsurance) You pay for certain Specialty Drugs, the reduced amount You pay may be the amount We apply to Your Deductible and/or Out-of-Pocket Limit when the Specialty Drug is provided by an In-Network Provider. Your eligibility to participate in such programs is dependent on the programs’ applicable terms and conditions, which may be subject to change from time to time. We may discontinue applying such reduced amounts to Your Cost Share at any given time. (Plan Contract, page 49 of 117 page document)

Maryland United Health Care: Ambivalent language leaves beneficiary unsure of policy

Coupons: The value of any manufacturer coupons applied to member cost share may not apply to deductibles or total member out-of-pocket limits. You may find information on manufacturer coupons that apply to out-of-pocket limits through the internet at myuhc.com. (Medical Policy, page 32 of 85 page document)

North Carolina United Health Care: Ambivalent language leaves beneficiary unsure of policy

Coupons: The value of any manufacturer coupons applied to member cost share may not apply to deductibles or total member out-of-pocket limits. (Medical Policy, page 29 of 75 page document)

Texas BlueCross/Blue Shield: Ambivalent language leaves beneficiary unsure of policy

Drug Coupons, Rebates, and Other Discounts. Third parties, including but not limited to drug manufacturers, may offer drug coupons, rebates or other drug discounts to Members, which may impact the benefits provided under this Evidence of Coverage. HMO does not accept cost-sharing payments from any third parties (except as described in HOW THE PLAN WORKS; Premium Payment. Drug coupons, rebates and other discounts may not be applied towards Your Deductible or Your out-of-pocket maximum. (Evidence of Coverage, page 49 of 129 page document)

Risk Adjustment

HIV+Hep is in support of updating the risk adjustment for hepatitis C curative drugs to reflect the drop in prices for those drugs. Additionally, in the past, CMS has discussed the risk adjustment for Pre-exposure Prophylaxis (PrEP), drugs that are used to prevent HIV. Now that non-grandfathered plans must cover PrEP without cost-sharing, we anticipate that there will be an increase in utilization of PrEP. In determining the risk-adjustment for PrEP, HIV+Hep trusts that costs in addition to the cost of the drug are included to cover the required ancillary services associated with PrEP use. This includes medical visits, HIV, hepatitis B and STI testing, along with renal tests.

Prescription Drug Rebates & Medical Loss Ratio Requirements

HIV+Hep is very supportive of the requirement that insurers must deduct prescription drug rebates and any other drug-related price concessions from the calculation of an insurer’s Medical Loss Ratio. In the NBPP proposed rule, CMS proposes a definition of rebates that seems to mirror the definition of rebates and price concessions used as part of the Medicare Part D program. However, HIV+Hep urges CMS to remove the word “coupons” from the definition. Unlike the Medicare Part D program, manufacturer coupons in the private market are allowed and go to the benefit of the patient. Therefore, they should not be included in the definition of rebates for these purposes.

PBM and Insurer Drug Distribution and Cost Reporting

HIV+Hep is pleased CMS is requiring PBMs and certain insurers to provide prescription drug information in compliance with the requirements of Section 6005 of the ACA. The filing of this information is long overdue. We are particularly interested in such data as the aggregate amount and the type of rebates, discounts, or price concessions attributable to patient utilization; the amount passed through to the plan sponsor; and the aggregate amount of the difference between the amount the health benefits plan pays the PBM and the amount that the PBM pays pharmacies. All of this information will help in any discussion of drug pricing and should be made public to the maximum extent possible.

HIV+Hepatitis Policy Institute thanks you for the opportunity to provide these comments. Should you have any questions, please feel free to contact me at cschmid@hivhep.org or (202) 462-3042.

Sincerely,

Carl E Schmid II

Executive Director